New to the UAE or simply exploring banking options? Below is our no nonsense guide for new and existing residents to get the most out of the WIO banking app.

If you’re new to Dubai or setting up life as an expat, getting your banking sorted can be surprisingly frustrating. Traditional banks often mean paperwork, branch visits, and waiting days for approval. That’s where WIO Bank comes in — a fully digital UAE bank that’s built for modern living.

This is your straightforward guide to what WIO offers, what to expect, and whether it’s the right choice for you.

WIO Bank PJSC is a digital bank licensed by the UAE Central Bank, headquartered in Abu Dhabi. It’s backed by ADQ, Etisalat (e&), and First Abu Dhabi Bank (FAB) — so while it’s modern and app-based, it’s not a startup experiment. It’s a regulated, government-backed entity built to bring banking into the 21st century.

WIO Personal is designed for freelancers, remote workers, and residents who want simplicity and transparency.

Highlights:

Open your account in minutes using Emirates ID and selfie verification.

Instant AED IBAN for salary deposits or transfers.

Zero minimum balance and no hidden fees.

International transfers via SWIFT (fees are mid-range, not the cheapest but reliable).

Integration with Apple Pay and Google Pay.

WIO’s Business account is where it really stands out — especially for startups, freelancers, and SMEs.

Key features:

Open a business account online in under 24 hours (compared to weeks with traditional banks).

Multiple sub-accounts for budgeting and VAT.

Seamless integration with Zoho Books and other accounting tools.

Invoicing and expense management built into the app.

Business debit cards for team members.

WIO is transparent about fees — no fine print.

Personal accounts: Free to open, no minimum balance.

Business accounts: AED 99/month (includes 3 free team cards and all features).

International transfers: Around AED 25–35 per transaction depending on currency.

ATM withdrawals: Free in the UAE from FAB ATMs; AED 2.10 for others.

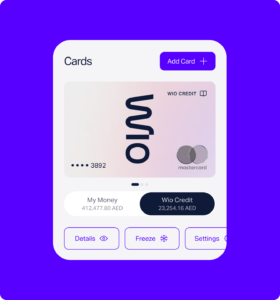

The WIO app is genuinely well-designed — clean, modern, and intuitive.

Dark/light modes, instant notifications, and slick UI.

You can freeze/unfreeze your card instantly.

Customer service chat is responsive (though sometimes chatbot-heavy before a human takes over).

International transfers can take 1–2 days, and FX rates aren’t always the most competitive.

No cash deposits — you’ll need to use FAB ATMs for that.

No cheque books (though few people use them anymore).

Customer service, while friendly, can be slow during peak hours.

Download the WIO Bank app (iOS or Android).

Verify using Emirates ID and facial recognition.

Provide your residence visa and basic details.

For business accounts, link your trade license (free zone or mainland).

Start using your account immediately.

If you value speed, transparency, and convenience, WIO is the UAE’s best digital banking option.

It’s perfect for:

New residents setting up life in Dubai

Entrepreneurs and freelancers needing a quick business account

Remote workers managing multi-currency transactions

If you’re running a large corporation or require heavy cash handling, you’ll still need a traditional bank relationship — but for 90% of expats, WIO is the simplest and smartest choice.

| Feature | WIO Rating |

|---|---|

| Account Setup |      |

| App Design |     ☆ ☆ |

| Fees Transparency |      |

| Customer Support |     ☆ ☆ |

| International Transfers |    ☆☆ ☆☆ |

Nova Citizen’s Take:

WIO Bank is the future of banking in the UAE — fast, transparent, and genuinely built for expats. It eliminates the bureaucracy that makes moving or starting a business here daunting. Whether you’re relocating to Dubai or launching your next venture, it’s one of the smartest financial moves you can make early on.

Would you like me to make this version branded for Nova Citizen (with intro/outro references, formatting, and tone aligned to your site or newsletter style)? I can tailor it to match your content voice (e.g., “The Nova Citizen Guide to…” style).

Inside this FREE comprehensive guide, we break down the steps to take to relocate to the most popular tax-friendly jurisdictions around the world. Start planning today and discover the improved quality of life that comes with becoming a sovereign individual.